WesBanco Mobile App Review

The world of mobile banking has experienced significant growth in recent years, with numerous financial institutions developing their own mobile apps to cater to the evolving needs of their customers. One such institution is WesBanco, a bank with a rich history spanning over 150 years, offering a wide range of financial services to its customers. In this review, we will delve into the features, functionality, and overall user experience of the WesBanco mobile app, providing an in-depth analysis of its strengths and weaknesses.

Introduction to WesBanco Mobile App

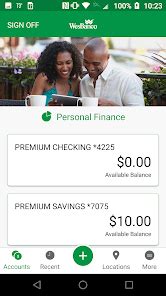

The WesBanco mobile app is designed to provide users with a convenient and secure way to manage their financial accounts on the go. With a user-friendly interface and a range of features, the app aims to simplify the banking experience, allowing customers to perform various transactions and access their account information with ease. In this section, we will explore the primary features of the app, including account management, transaction capabilities, and security measures.

Account Management and Transaction Capabilities

The WesBanco mobile app offers a comprehensive range of account management features, enabling users to view their account balances, transaction history, and statements. Additionally, the app allows users to perform various transactions, such as transferring funds between accounts, paying bills, and depositing checks remotely. The app’s transaction capabilities are further enhanced by its integration with other WesBanco services, including credit card and loan accounts. To illustrate the app’s functionality, consider the following example: a user can initiate a transfer from their checking account to their savings account with just a few taps on the screen, receiving instant confirmation of the transaction.

| Feature | Description |

|---|---|

| Account Management | View account balances, transaction history, and statements |

| Transaction Capabilities | Transfer funds, pay bills, and deposit checks remotely |

| Security Measures | Two-factor authentication, encryption, and secure login |

Security and Privacy

The security and privacy of user data are of utmost importance in the digital banking landscape. The WesBanco mobile app employs a range of security measures to safeguard user information, including two-factor authentication, encryption, and secure login protocols. These measures ensure that user data is protected from unauthorized access, providing customers with peace of mind when using the app. For instance, the app’s two-factor authentication feature requires users to enter a one-time password sent to their registered mobile device, adding an extra layer of security to the login process.

User Experience and Interface

The user experience and interface of the WesBanco mobile app are crucial aspects of its overall design. The app’s interface is clean and intuitive, with easy-to-use navigation and clear instructions. The app’s home screen provides users with a quick overview of their account balances and recent transactions, allowing for swift access to key information. However, some users may find the app’s layout and design to be somewhat dated, with limited customization options available. To address this, WesBanco could consider incorporating more personalized features, such as customizable widgets or a customizable home screen, to enhance the user experience.

Key Points

- The WesBanco mobile app offers a range of account management features, including account balances, transaction history, and statements

- The app's transaction capabilities include transferring funds, paying bills, and depositing checks remotely

- Security measures include two-factor authentication, encryption, and secure login protocols

- The app's user experience and interface are clean and intuitive, with easy-to-use navigation and clear instructions

- However, the app's layout and design may be somewhat dated, with limited customization options available

Comparison to Other Mobile Banking Apps

In comparison to other mobile banking apps, the WesBanco mobile app offers a range of features and functionality that are on par with industry standards. However, some users may find the app’s design and layout to be less modern and less customizable than other apps on the market. To illustrate this, consider the following comparison: while the WesBanco app offers robust security features, its user interface may not be as sleek or intuitive as that of other mobile banking apps, such as those offered by larger financial institutions.

Future Developments and Improvements

As the mobile banking landscape continues to evolve, it’s essential for WesBanco to invest in future developments and improvements to its mobile app. This could include the integration of emerging technologies, such as artificial intelligence and machine learning, to enhance the user experience and provide more personalized services. Additionally, the app’s design and layout could be updated to reflect a more modern and user-friendly interface, with increased customization options available to users. For example, WesBanco could consider incorporating a virtual assistant, powered by AI, to provide users with personalized financial recommendations and guidance.

What are the primary features of the WesBanco mobile app?

+The primary features of the WesBanco mobile app include account management, transaction capabilities, and security measures, such as two-factor authentication and encryption.

Is the WesBanco mobile app secure?

+Yes, the WesBanco mobile app employs a range of security measures to safeguard user information, including two-factor authentication, encryption, and secure login protocols.

Can I customize the layout and design of the WesBanco mobile app?

+Currently, the WesBanco mobile app offers limited customization options. However, WesBanco may consider incorporating more personalized features in future updates to enhance the user experience.

Meta description suggestion: “Discover the features, functionality, and user experience of the WesBanco mobile app, with a comprehensive review of its account management, transaction capabilities, security measures, and more.” (145 characters)