5 Tips Simmons Bank Mobile

As a leading financial institution, Simmons Bank has been at the forefront of providing innovative banking solutions to its customers. With the rise of mobile banking, Simmons Bank has developed a comprehensive mobile banking platform that allows users to manage their finances on-the-go. In this article, we will provide 5 tips on how to get the most out of Simmons Bank Mobile, highlighting its features, benefits, and best practices for secure and efficient mobile banking.

Key Points

- Download and install the Simmons Bank Mobile app from the App Store or Google Play

- Set up account alerts and notifications to stay informed about your account activity

- Use the mobile deposit feature to deposit checks remotely

- Take advantage of mobile banking security features, such as two-factor authentication and encryption

- Use the Simmons Bank Mobile app to pay bills, transfer funds, and manage your accounts

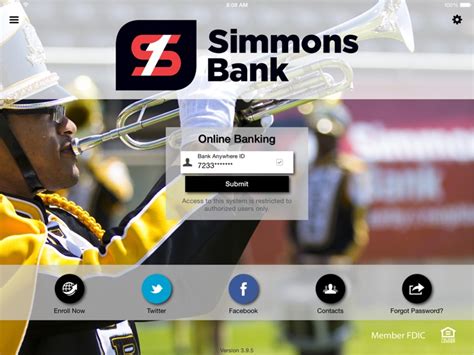

Getting Started with Simmons Bank Mobile

To start using Simmons Bank Mobile, you will need to download and install the app from the App Store or Google Play. Once you have installed the app, you will need to set up your account by logging in with your online banking credentials. If you are not already enrolled in online banking, you can do so through the Simmons Bank website. The app is available for both iOS and Android devices, and it is compatible with a wide range of devices, including smartphones and tablets.

Setting Up Account Alerts and Notifications

One of the key features of Simmons Bank Mobile is the ability to set up account alerts and notifications. These alerts can be customized to notify you of various account activities, such as low balance, large transactions, or suspicious activity. To set up account alerts, log in to the app, navigate to the “Settings” menu, and select “Account Alerts.” From there, you can choose the types of alerts you want to receive and how you want to receive them (e.g., via push notification, email, or text message). For example, you can set up an alert to notify you when your account balance falls below a certain threshold, or when a large transaction is made.

| Alert Type | Description |

|---|---|

| Low Balance Alert | Notifies you when your account balance falls below a certain threshold |

| Large Transaction Alert | Notifies you when a large transaction is made on your account |

| Suspicious Activity Alert | Notifies you of suspicious activity on your account, such as a transaction from an unfamiliar location |

Mobile Deposit and Other Features

Simmons Bank Mobile also offers a range of other features that can make managing your finances easier and more convenient. For example, you can use the mobile deposit feature to deposit checks remotely, without having to visit a branch or ATM. To use mobile deposit, simply log in to the app, navigate to the “Deposit” menu, and follow the prompts to take a photo of the check and submit it for deposit. The mobile deposit feature is available 24⁄7, and deposits are typically processed within one business day.

Security Features and Best Practices

Simmons Bank Mobile takes security seriously, with a range of features designed to protect your account information and prevent unauthorized access. These features include two-factor authentication, encryption, and secure login credentials. To further protect your account, it is recommended that you use a strong password, keep your device and app up to date, and avoid using public Wi-Fi or unsecured networks to access your account. Additionally, you should always log out of the app when you are finished using it, and avoid sharing your login credentials with anyone.

In addition to these security features, Simmons Bank Mobile also offers a range of educational resources and tips to help you stay safe online. These resources include articles, videos, and tutorials on topics such as password security, phishing, and online scams. By taking advantage of these resources and following best practices for mobile banking security, you can help protect your account and prevent unauthorized access.

What is Simmons Bank Mobile, and how do I get started?

+Simmons Bank Mobile is a mobile banking app that allows you to manage your finances on-the-go. To get started, download and install the app from the App Store or Google Play, and then set up your account by logging in with your online banking credentials.

Is Simmons Bank Mobile secure, and what features are in place to protect my account?

+Yes, Simmons Bank Mobile is secure, with features such as two-factor authentication, encryption, and secure login credentials in place to protect your account. Additionally, you can take steps to further protect your account by using a strong password, keeping your device and app up to date, and avoiding public Wi-Fi or unsecured networks.

Can I use Simmons Bank Mobile to pay bills and transfer funds?

+Yes, Simmons Bank Mobile allows you to pay bills and transfer funds, as well as manage your accounts and monitor your account activity. You can use the app to pay bills, transfer funds between accounts, and even send money to friends and family.

In conclusion, Simmons Bank Mobile is a powerful tool that can help you manage your finances more efficiently and effectively. By following these 5 tips and taking advantage of the app’s features and security measures, you can get the most out of mobile banking and stay on top of your finances. Whether you are a busy professional or an individual looking for a convenient way to manage your finances, Simmons Bank Mobile is an excellent choice. With its user-friendly interface, robust security features, and wide range of features and functionality, Simmons Bank Mobile is an essential tool for anyone looking to take control of their finances.