5 Mobile Banking Tips

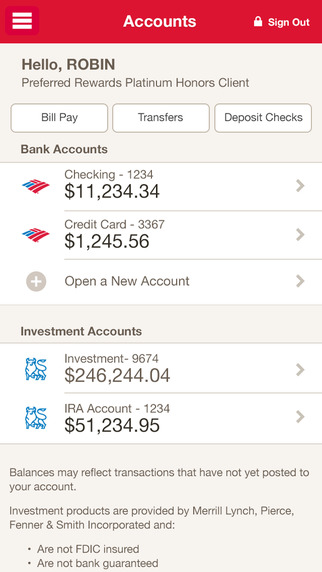

With the rise of mobile banking, managing your finances has become more convenient than ever. Gone are the days of waiting in line at the bank or sitting at your desk to pay bills. Mobile banking apps have made it possible to handle all your banking needs from the palm of your hand. However, with this increased convenience comes the need for vigilance in protecting your financial information. Here are some essential tips to help you navigate the world of mobile banking securely and efficiently.

Key Points

- Enable two-factor authentication to add an extra layer of security to your mobile banking app.

- Regularly update your mobile banking app to ensure you have the latest security patches and features.

- Use strong, unique passwords for your mobile banking app and consider enabling biometric authentication.

- Monitor your account activity regularly to quickly identify and report any suspicious transactions.

- Only use secure, trusted networks when accessing your mobile banking app to protect your data from interception.

Understanding Mobile Banking Security

Mobile banking security is a multifaceted issue that involves both the bank’s responsibility to provide a secure platform and the user’s role in protecting their personal and financial information. One of the primary concerns with mobile banking is the risk of data breaches or unauthorized access to your account. To mitigate this risk, many banks offer two-factor authentication, which requires both your password and a second form of verification (such as a fingerprint, face ID, or a code sent to your phone) to access your account.

Implementing Strong Passwords and Biometric Authentication

A strong password is your first line of defense against unauthorized access. When creating a password for your mobile banking app, it’s essential to use a combination of uppercase and lowercase letters, numbers, and special characters. Furthermore, each of your passwords should be unique to prevent a breach in one account from compromising others. Biometric authentication, such as fingerprint or facial recognition, offers an additional layer of security, making it more difficult for hackers to gain access to your account.

| Security Measure | Description |

|---|---|

| Two-Factor Authentication | Requires a second form of verification in addition to your password. |

| Strong Passwords | Unique combinations of characters, numbers, and special characters. |

| Biometric Authentication | Uses physical characteristics like fingerprints or face ID for verification. |

Staying Ahead of Scams and Phishing Attempts

Scammers and phishing attempts are becoming increasingly sophisticated, making it essential to stay informed and cautious. Never provide your banking information or passwords in response to emails, texts, or calls, even if they appear to be from your bank. Legitimate banks will never ask for sensitive information via these channels. Additionally, be wary of public Wi-Fi when accessing your mobile banking app, as these networks can be easily intercepted by hackers.

Regular Updates and Secure Connections

Keeping your mobile banking app updated is crucial for ensuring you have the latest security features and patches. Banks regularly release updates to fix vulnerabilities and improve security, so it’s essential to install these updates as soon as they become available. Furthermore, only access your mobile banking app over secure, trusted networks. If you must use public Wi-Fi, consider using a virtual private network (VPN) to encrypt your data and protect it from interception.

In conclusion, mobile banking offers a convenient and efficient way to manage your finances, but it requires a proactive approach to security. By enabling two-factor authentication, using strong and unique passwords, monitoring your account activity, staying cautious of scams, and keeping your app updated, you can significantly reduce the risk of your financial information being compromised. Remember, security is a shared responsibility between you and your bank, and by taking these steps, you can enjoy the benefits of mobile banking with peace of mind.

What is two-factor authentication, and how does it enhance mobile banking security?

+Two-factor authentication is a security process in which users are granted access to a system or application only after successfully presenting two separate factors: something they know (like a password) and something they have (like a fingerprint or a code sent to their phone). This adds an extra layer of security, making it more difficult for unauthorized users to gain access.

How can I protect my mobile banking app from being accessed if my phone is lost or stolen?

+Enable the remote wipe feature on your phone to erase all data, including your mobile banking app, in case your phone is lost or stolen. Additionally, report the incident to your bank immediately so they can take steps to secure your account.

What should I do if I notice a suspicious transaction on my account?

+Contact your bank’s customer service immediately to report the suspicious transaction. They will guide you through the process of securing your account and potentially reversing the transaction. It’s also a good idea to change your password and monitor your account closely for any further suspicious activity.