Lending Club Mobile App

The Lending Club mobile app is a user-friendly and convenient way for investors and borrowers to manage their accounts on the go. As one of the pioneering peer-to-peer lending platforms, Lending Club has expanded its services to cater to the increasing demand for mobile accessibility. With the Lending Club mobile app, users can access a wide range of features, including account management, investment tracking, and loan applications, all from the palm of their hand.

Key Features of the Lending Club Mobile App

The Lending Club mobile app offers a variety of features that make it an essential tool for both investors and borrowers. Some of the key features include:

- Account Management: Users can easily access and manage their accounts, including viewing account balances, transaction history, and investment portfolios.

- Investment Tracking: Investors can track the performance of their investments, including returns, defaults, and recovery rates.

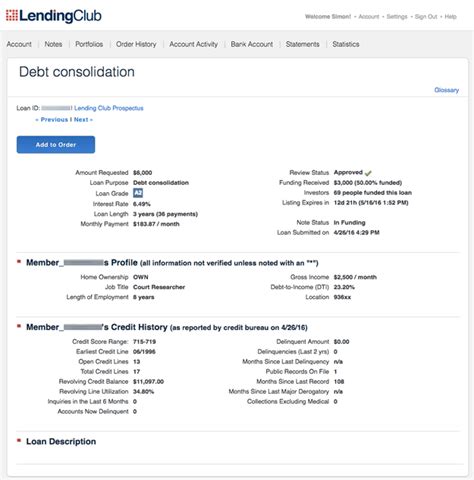

- Loan Applications: Borrowers can apply for loans directly through the app, with the option to upload required documents and track the status of their application.

- Payment Management: Borrowers can make payments on their loans, view payment schedules, and access payment history.

- Customer Support: Users can access customer support directly through the app, with options for phone, email, and in-app messaging.

Investor Features

For investors, the Lending Club mobile app provides a range of features that make it easy to manage their investment portfolios. Some of the key investor features include:

Investment Diversification: Investors can diversify their portfolios by investing in a range of loans with different risk grades and interest rates.

Auto-Invest: Investors can set up an auto-invest feature, which allows them to automatically invest in new loans that meet their specified criteria.

Return Tracking: Investors can track the returns on their investments, including net returns, defaults, and recovery rates.

| Investment Option | Minimum Investment | Expected Return |

|---|---|---|

| Grade A Loans | $25 | 5.06% - 7.03% |

| Grade B Loans | $25 | 6.03% - 8.04% |

| Grade C Loans | $25 | 7.02% - 9.04% |

Borrower Features

For borrowers, the Lending Club mobile app provides a range of features that make it easy to apply for and manage loans. Some of the key borrower features include:

Loan Application: Borrowers can apply for loans directly through the app, with the option to upload required documents and track the status of their application.

Payment Management: Borrowers can make payments on their loans, view payment schedules, and access payment history.

Customer Support: Borrowers can access customer support directly through the app, with options for phone, email, and in-app messaging.

Key Points

- The Lending Club mobile app provides users with a convenient and user-friendly way to manage their accounts on the go.

- Investors can track the performance of their investments, including returns, defaults, and recovery rates.

- Borrowers can apply for loans directly through the app, with the option to upload required documents and track the status of their application.

- The app provides a range of features for both investors and borrowers, including account management, investment tracking, and loan applications.

- It's essential to carefully review the terms and conditions of each loan, as well as the risk associated with investing in peer-to-peer lending.

Security and Compliance

The Lending Club mobile app prioritizes security and compliance, with a range of measures in place to protect user data and ensure compliance with regulatory requirements. Some of the key security and compliance features include:

Encryption: The app uses encryption to protect user data, both in transit and at rest.

Two-Factor Authentication: Users can enable two-factor authentication to add an extra layer of security to their accounts.

Compliance: The app is designed to comply with relevant regulatory requirements, including the Gramm-Leach-Bliley Act (GLBA) and the Dodd-Frank Wall Street Reform and Consumer Protection Act.

What is the minimum investment required to start investing with Lending Club?

+The minimum investment required to start investing with Lending Club is $25.

How do I apply for a loan through the Lending Club mobile app?

+To apply for a loan through the Lending Club mobile app, simply download the app, click on the "Apply for a Loan" button, and follow the prompts to upload required documents and track the status of your application.

What is the expected return on investment for Lending Club investors?

+The expected return on investment for Lending Club investors varies depending on the risk grade and interest rate of the loan. However, investors can expect to earn net returns ranging from 5.06% to 9.04% per annum.

In conclusion, the Lending Club mobile app provides users with a convenient and user-friendly way to manage their accounts on the go. With a range of features for both investors and borrowers, the app is an essential tool for anyone looking to invest in or borrow through the Lending Club platform. As with any investment, it’s essential to carefully review the terms and conditions of each loan, as well as the risk associated with investing in peer-to-peer lending. However, for those looking to diversify their investment portfolios or access affordable loans, the Lending Club mobile app is definitely worth considering.