5 Mobile Deposit Tips

With the rise of mobile banking, depositing checks has become easier than ever. Mobile deposit allows users to deposit checks remotely using their mobile device, eliminating the need to visit a physical bank branch. However, to ensure a smooth and secure mobile deposit experience, it's essential to follow some best practices. In this article, we'll explore five mobile deposit tips to help you make the most out of this convenient service.

Key Points

- Ensure you have a compatible mobile device and banking app

- Understand the deposit limits and funds availability

- Take clear and legible photos of the check

- Endorse the check correctly and include the mobile deposit endorsement

- Monitor your account for deposit confirmation and potential issues

Understanding Mobile Deposit Basics

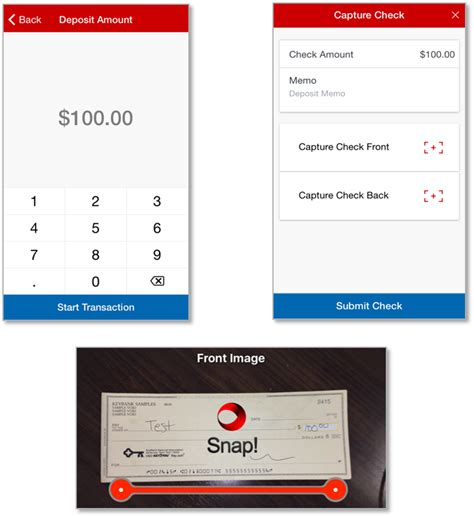

Before we dive into the tips, it’s crucial to understand the basics of mobile deposit. Mobile deposit typically involves taking a photo of the front and back of the check using your mobile device’s camera, and then submitting it through your banking app. The app will guide you through the process, which usually includes selecting the account to deposit into, entering the check amount, and reviewing the deposit details.

Tip 1: Check Compatibility and App Requirements

Not all mobile devices or banking apps support mobile deposit. It’s essential to check with your bank to see if they offer mobile deposit and if your device is compatible. Typically, you’ll need a smartphone with a decent camera and a stable internet connection. Additionally, ensure you have the latest version of your banking app installed, as updates often include security patches and feature enhancements.

Tip 2: Know Your Deposit Limits and Funds Availability

Mobile deposit typically has limits on the amount you can deposit in a single transaction or over a certain period. These limits vary by bank and can be influenced by your account type, history, and other factors. It’s also important to understand when the deposited funds will become available. Some banks may make funds available immediately, while others may hold them for a few days. Knowing these details can help you plan your finances and avoid potential issues.

| Bank | Mobile Deposit Limit | Funds Availability |

|---|---|---|

| Bank of America | $5,000 per day | Next business day |

| Wells Fargo | $2,500 per day | Same day for eligible accounts |

| Chase Bank | $10,000 per day | Next business day for most accounts |

Tip 3: Take Clear and Legible Photos

The quality of the check photos is crucial for a successful mobile deposit. Ensure the check is placed on a flat surface, and the camera is directly above it. Take photos in a well-lit area, and avoid shadows or glares. It’s also essential to position the check within the app’s guidelines to ensure all necessary details are captured. A clear and legible photo will reduce the likelihood of errors or rejections.

Tip 4: Endorse the Check Correctly

Proper check endorsement is vital for mobile deposit. Typically, you’ll need to sign the back of the check and include the mobile deposit endorsement, which may be specified by your bank. This endorsement usually includes the phrase “For mobile deposit only” or something similar. Ensure you follow your bank’s guidelines for endorsement, as incorrect or missing endorsements can lead to deposit rejection.

Tip 5: Monitor Your Account

After submitting your mobile deposit, it’s essential to monitor your account for confirmation and potential issues. Check your account balance and transaction history to ensure the deposit has been processed correctly. If you encounter any issues, such as a rejected deposit or delayed funds availability, contact your bank’s customer support for assistance.

What happens if my mobile deposit is rejected?

+If your mobile deposit is rejected, you'll typically receive a notification from your bank. The reason for rejection may be due to a variety of factors, such as incorrect endorsement, poor image quality, or exceeded deposit limits. You can try re-submitting the deposit or contacting your bank's customer support for assistance.

Can I deposit multiple checks at once using mobile deposit?

+Some banking apps may allow you to deposit multiple checks at once, while others may require you to submit each check separately. Check with your bank to see if they support multiple check deposits and follow their guidelines for the process.

Is mobile deposit secure?

+Mobile deposit is generally considered secure, as it uses encryption and other security measures to protect your data. However, it's essential to follow best practices, such as using a secure internet connection, keeping your device and app up to date, and monitoring your account activity regularly.

By following these five mobile deposit tips, you can ensure a smooth and secure remote deposit experience. Remember to always check with your bank for specific guidelines and requirements, as they may vary. With mobile deposit, you can enjoy the convenience of depositing checks from anywhere, at any time, while maintaining control over your finances.