5 ICICI App Tips

The ICICI app, designed by ICICI Bank, is a comprehensive mobile banking platform that allows users to manage their financial transactions, accounts, and investments with ease. With a wide range of features and services, the app has become an essential tool for ICICI Bank customers. Here, we will explore five valuable tips to help users maximize the benefits of the ICICI app and enhance their mobile banking experience.

Key Points

- Setting up a secure login to protect account information

- Utilizing the bill payment and fund transfer features for convenience

- Tracking account activity and transaction history

- Accessing investment and insurance services through the app

- Customizing the app's home screen for personalized banking

Secure Login and Account Protection

To ensure the security of their account information, users should prioritize setting up a secure login on the ICICI app. This can be achieved by creating a unique username and password, enabling two-factor authentication, and regularly updating their login credentials. Additionally, users can take advantage of the app’s biometric login feature, which allows for fingerprint or facial recognition authentication. By implementing these security measures, users can protect their accounts from unauthorized access and enjoy a safe mobile banking experience.

Convenient Bill Payments and Fund Transfers

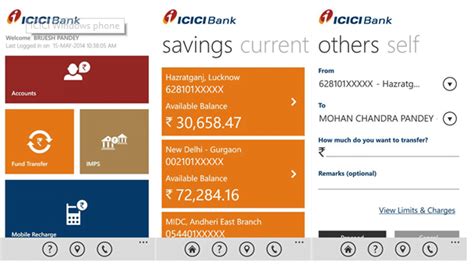

The ICICI app offers a convenient and efficient way to pay bills and transfer funds. Users can link their credit cards, loan accounts, and other billers to the app, allowing them to make payments quickly and easily. The app also supports various fund transfer options, including NEFT, RTGS, and IMPS, making it simple to send and receive money. By utilizing these features, users can streamline their financial transactions and save time.

| Transaction Type | Transaction Limit |

|---|---|

| NEFT | ₹ 10,00,000 per transaction |

| RTGS | ₹ 2,00,000 to ₹ 10,00,000 per transaction |

| IMPS | ₹ 2,00,000 per transaction |

Tracking Account Activity and Transaction History

The ICICI app allows users to track their account activity and transaction history with ease. Users can view their account balances, transaction details, and payment history, enabling them to stay on top of their finances. The app also provides customizable alerts and notifications, which can be set up to inform users of incoming transactions, payment due dates, and account activity. By monitoring their account activity, users can detect any suspicious transactions and take prompt action to prevent financial losses.

Accessing Investment and Insurance Services

The ICICI app offers a range of investment and insurance services, allowing users to manage their financial portfolios and protect their assets. Users can invest in mutual funds, fixed deposits, and other investment products, as well as purchase insurance policies and track their policy details. The app also provides tools and resources to help users make informed investment decisions and plan their financial futures. By accessing these services through the app, users can consolidate their financial management and achieve their long-term goals.

Customizing the App’s Home Screen

To enhance their mobile banking experience, users can customize the ICICI app’s home screen to suit their preferences. The app allows users to add or remove widgets, rearrange the layout, and personalize the appearance of the home screen. Users can also set up shortcuts to frequently used features and services, making it easier to navigate the app and access the information they need. By customizing the home screen, users can create a tailored banking experience that meets their unique needs and preferences.

How do I reset my ICICI app password?

+To reset your ICICI app password, go to the login page and click on "Forgot Password." Follow the prompts to enter your username, account number, and other required details. You will then receive a password reset link on your registered email or mobile number.

Can I use the ICICI app to pay my credit card bill?

+Yes, you can use the ICICI app to pay your credit card bill. Simply log in to the app, navigate to the "Bill Pay" section, and select your credit card account. Enter the payment amount and confirm the transaction to complete the payment.

How do I track my account activity on the ICICI app?

+To track your account activity on the ICICI app, log in to the app and navigate to the "Account Summary" section. You can view your account balances, transaction history, and payment details. You can also set up customizable alerts and notifications to stay informed about your account activity.

In conclusion, the ICICI app is a powerful tool for managing finances, and by following these five tips, users can unlock its full potential. By prioritizing security, utilizing convenient features, tracking account activity, accessing investment and insurance services, and customizing the app’s home screen, users can enjoy a seamless and personalized mobile banking experience. As the ICICI app continues to evolve and improve, users can expect even more innovative features and services to enhance their financial management and achieve their long-term goals.