5 Home Bank Mobile App Tips

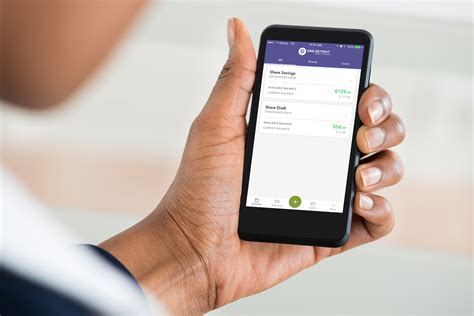

The rise of mobile banking has revolutionized the way we manage our finances, with home bank mobile apps leading the charge. These apps offer a convenient and secure way to access your accounts, pay bills, and transfer funds from the comfort of your own home. However, to get the most out of your home bank mobile app, it's essential to use it effectively and securely. Here are five tips to help you maximize the benefits of your home bank mobile app.

Key Points

- Enable two-factor authentication for enhanced security

- Set up account alerts for timely notifications

- Use the app's budgeting tools to track your expenses

- Take advantage of mobile deposit features

- Regularly update the app to ensure you have the latest security patches and features

Security First: Enable Two-Factor Authentication

Security is a top priority when it comes to mobile banking. One of the most effective ways to protect your accounts is by enabling two-factor authentication (2FA). This feature requires you to provide a second form of verification, such as a fingerprint, face ID, or a one-time password sent to your phone or email, in addition to your login credentials. By enabling 2FA, you add an extra layer of security, making it much harder for unauthorized individuals to access your accounts. For instance, a study by Google found that 2FA can prevent up to 100% of automated bot attacks. To enable 2FA, navigate to your app’s settings menu, look for the security or login settings section, and follow the prompts to set up this feature.

Stay Informed: Set Up Account Alerts

Staying on top of your finances requires timely and relevant information. Your home bank mobile app can help you achieve this by setting up account alerts. These alerts can notify you of low account balances, large transactions, or suspicious activity. To set up account alerts, go to the notifications or account settings section of your app, and select the types of alerts you want to receive. You can usually choose to receive alerts via push notifications, email, or text message. For example, Citibank offers customizable account alerts that can be tailored to your specific needs. By setting up these alerts, you can respond quickly to any potential issues and avoid overdrafts or fraudulent transactions.

Budgeting Made Easy: Utilize the App’s Budgeting Tools

Effective budgeting is crucial for managing your finances. Many home bank mobile apps offer built-in budgeting tools that can help you track your expenses and stay within your means. These tools often categorize your transactions, providing a clear picture of where your money is going. To access these tools, look for the budgeting or spending section within your app. You may need to link your accounts or set up budgets for specific categories. For instance, Mint offers a comprehensive budgeting feature that allows you to set financial goals and track your progress. By using these tools, you can identify areas for improvement and make informed decisions about your spending habits.

Deposit Checks on the Go: Take Advantage of Mobile Deposit

Mobile deposit is a convenient feature that allows you to deposit checks remotely using your mobile device. This feature can save you time and effort, as you no longer need to visit a bank branch or ATM to deposit a check. To use mobile deposit, navigate to the deposit or transfer section of your app, select the account you want to deposit into, and follow the prompts to take a photo of the check. Make sure to endorse the check and include any required information, such as your account number. For example, Bank of America offers a mobile deposit feature that allows you to deposit checks up to $5,000. Be sure to review and understand any deposit limits, fees, or processing times associated with this feature.

Stay Up-to-Date: Regularly Update Your App

Finally, it’s essential to keep your home bank mobile app up-to-date to ensure you have the latest security patches and features. Updates often include bug fixes, performance improvements, and new functionalities that can enhance your mobile banking experience. To update your app, visit the app store on your device, search for your bank’s app, and click the update button. You can also enable automatic updates in your device’s settings to ensure you never miss an update. For instance, Apple offers automatic update features for iOS devices, allowing you to stay current with the latest app updates.

What is two-factor authentication, and how does it work?

+Two-factor authentication is a security feature that requires you to provide a second form of verification, such as a fingerprint, face ID, or a one-time password, in addition to your login credentials. This adds an extra layer of security, making it harder for unauthorized individuals to access your accounts.

How do I set up account alerts in my home bank mobile app?

+To set up account alerts, navigate to the notifications or account settings section of your app, and select the types of alerts you want to receive. You can usually choose to receive alerts via push notifications, email, or text message.

What are the benefits of using the budgeting tools in my home bank mobile app?

+The budgeting tools in your home bank mobile app can help you track your expenses, identify areas for improvement, and make informed decisions about your spending habits. These tools often categorize your transactions, providing a clear picture of where your money is going.

How do I use mobile deposit in my home bank mobile app?

+To use mobile deposit, navigate to the deposit or transfer section of your app, select the account you want to deposit into, and follow the prompts to take a photo of the check. Make sure to endorse the check and include any required information, such as your account number.

Why is it important to regularly update my home bank mobile app?

+Regularly updating your home bank mobile app ensures you have the latest security patches and features. Updates often include bug fixes, performance improvements, and new functionalities that can enhance your mobile banking experience.

In conclusion, by following these five tips, you can maximize the benefits of your home bank mobile app and take control of your finances. Remember to enable two-factor authentication, set up account alerts, utilize the app’s budgeting tools, take advantage of mobile deposit, and regularly update your app. By doing so, you can ensure a secure, convenient, and effective mobile banking experience.